Smarter Credit Risk Monitoring System

for Confident Decisions

We provide clarity in credit risk management to help your business succeed in any environment.

Smarter Credit Risk Monitoring System for Confident Decisions

We provide clarity in credit risk management

to help your business succeed in any environment.

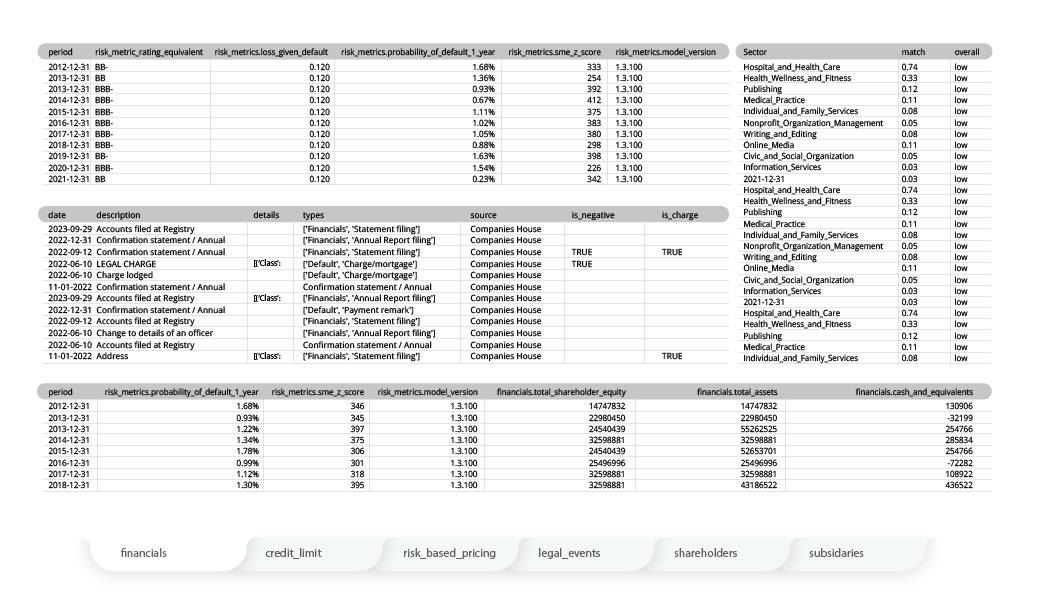

Extensive data pool for a fuller picture

By sifting through financial, non-financial, and macroeconomic data, our robust credit risk monitoring system enables informed decision-making.

Smarter tech for a swifter credit risk monitoring

Using advanced tech to process data more effectively and faster than ever before.

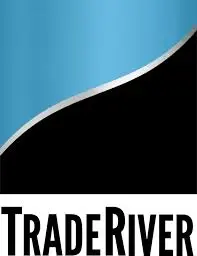

30% more accurate for sharp decision-making

Compiling the most accurate credit risk profiles available on the market.

Extensive data pool for a fuller picture

Sifting financial, non-financial and macroeconomic data to build the most comprehensive company profile possible.

Smarter tech for a swifter risk solution

Using advanced tech to process data more effectively and faster than ever before.

30% more accurate for sharp decision-making

Compiling the most accurate credit risk profiles available on the market.

Our solutions

Collate the raw information, organise it,

extract the value

Collate the raw information, organise it and extract the value

With a credit monitoring system that is clear, customisable and easy to use.

Enhancing your understanding

01

Giving you the insight to make sound judgements

02

And empowering you to proactively manage your portfolio

03

Enhancing your understanding

01

Giving you the insight to make sound judgements

02

And empowering you to proactively manage your portfolio

03

Collate the raw information, organise it and extract the value

Collate the raw information, organise it and extract the value

Enhancing your understanding

01

Giving you the insight to make sound judgements

02

And empowering you to proactively manage your portfolio

03

Enhancing your understanding

01

Giving you the insight to make sound judgements

02

And empowering you to proactively manage your portfolio

03

Tap into our unparall eled expertise. Founded by Professor Ed Altman and Dr. Gabriele Sabato, global authorities in the field of risk modelling, we combine the finest in academic research with proprietary risk models and decades of market experience.

Harness the power of the latest AI techniques and cutting-edge tech in a SaaS solution. Easily integrated into your existing systems, our platform delivers all the benefits of automation in an easy-to-use package.

Spot opportunities, identify market trends and highlight future threats. Our solutions comprise more than 76 geographic and sector-specific risk models, helping you hone in with exceptional detail and see what action needs to be taken.

Tap into our unparalleled expertise. Founded by Professor Ed Altman and Dr. Gabriele Sabato, global authorities in the field of risk modelling, we combine the finest in academic research with proprietary risk models and decades of market experience.

Harness the power of the latest AI techniques and cutting-edge tech in a SaaS solution. Easily integrated into your existing systems, our platform delivers all the benefits of automation in an easy-to-use package.

Spot opportunities, identify market trends and highlight future threats. Our solutions comprise more than 76 geographic and sector-specific risk models, helping you hone in with exceptional detail and see what action needs to be taken.

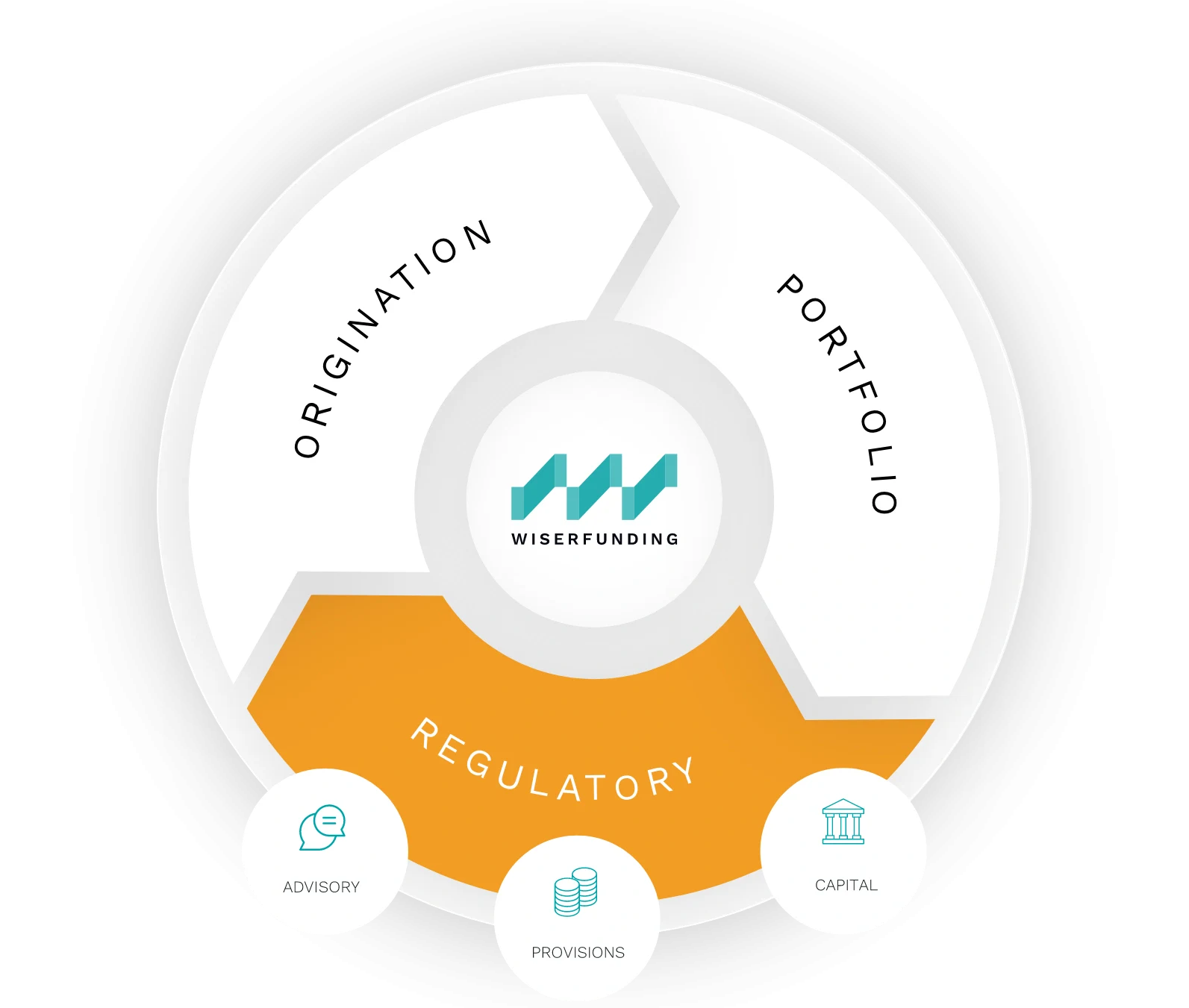

OUR SOLUTIONS

Origination

Find, screen and assess potential prospects more effectively

With richer insights based on a wealth of data points, our credit risk monitoring system provides an in-depth understanding of every company. It also gives you a clear view of the wider context in which they operate.

OUR SOLUTIONS

Portfolio

Sharpen portfolio performance

Hone your portfolio strategy with detailed insights to spot patterns, respond to changing conditions, and make proactive investment decisions.

OUR SOLUTIONS

Regulatory

Take the legwork out of regulatory compliance

Make decisions in full confidence that they are fully compliant with the latest regulations.

Save time on credit risk monitoring

Get the clarity you need at the click of a button

Gain comprehensive insights into individual companies and a broader overview of the market. Our platform enhances your understanding, enabling fast, proactive decision-making.

By automating laborious, manual tasks, it saves your analysts valuable time. This allows them to focus their expertise and helps you stay one step ahead.

Save

Get the clarity you need at the click of a button

Giving you a comprehensive insight into individual companies, and a broader overview of the market, our platform enhances your understanding for fast, proactive decision making.

Automating laborious, manual tasks saves your analysts time to better focus their expertise, allowing you to keep one step ahead.

Make smarter decisions

Make confident, compliant decisions based on sound judgements.

Offering 30% more accurate insights, our platform uses real-time data for up-to-the-minute risk assessments. We draw on over 800 data points for every borrower, ensuring our insights are second to none.

Understand a company’s risk profile in seconds. Gain a more comprehensive view of your portfolio’s risk exposure. Additionally, our customisable platform can be tailored to your needs, providing richer insights to help you make the right decisions for your business.

Streamline

your operations

Enhance your operations with our easily integrated solutions.

Automatic screening of potential prospects and clear organisation of data helps you identify targets, opportunities, and pitfalls. Your existing processes run with seamless efficiency, enhanced by the insights of our credit risk monitoring system.

Fully regulation-compliant and always up-to-date, our solutions eliminate the legwork. This allows you to make informed business decisions with full confidence.

Scale Your business

Strengthen your position and make accurate predictions to drive your success.

Automate your processes with robust credit risk monitoring to save resources on simple tasks. Enhance your understanding to make more confident, proactive decisions, helping you spot opportunities and drive business growth.

Save time

for what matters

Get the clarity you need at the click of a button

Giving you a comprehensive insight into individual companies, and a broader overview of the market, our platform enhances your understanding for fast, proactive decision making.

Automating laborious, manual tasks saves your analysts time to better focus their expertise, allowing you to keep one step ahead.

Save time for what matters

Get the clarity you need at the click of a button

Our platform gives you a comprehensive insight into individual companies and a broader overview of the market. This enhances your understanding, enabling fast and proactive decision-making.

By automating laborious manual tasks, you save valuable analyst time. This allows them to focus their expertise where it matters most, helping you stay one step ahead.

Make smarter decisions

Make confident, compliant decisions

based on sound judgements.

Offering 30% more accurate insights, using real-time data for up-to-the minute risk assessments, and drawing on over 800 data points for every SME, our insights are second to none.

Understand a company’s risk profile in seconds and gain a more rounded perspective on your portfolio’s risk exposure. Our customisable platform can be shaped to your needs, giving you richer insights to help you make the right decisions for your business.

Streamline your operations

Enhance your operations with our easily integrated solutions.

Automatic screening of potential prospects and clear organisation of the data helps you identify targets, opportunities and pitfalls. Your existing processes can run with seamless efficiency enhanced by the insights of our platform.

Fully regulation-compliant and always up-to-date, our solutions take out the legwork, leaving you to make informed business decisions in full confidence.

Strengthen your position and make accurate predictions to drive your success.

Automate your processes to save time and resource on the simple things. Enhance your understanding to help you make more confident, proactive decisions allowing you to spot opportunities and drive business growth.

Scale Your business

Trusted by Industry Leaders

“Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.”

“As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.”

“Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant, with new FCA regulations”

Trusted by Industry leaders:

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»