OUR STORY SO FAR…

1968

1968

2003

2003

2016-2017

2016-2017

2018-2019

2018-2019

2020

2020

2021

2021

2022

2022

2023

2023

OUR team

Our team of experts and trailblazers

combines the best of academia and innovation.

Our team of experts and trailblazers

combines the best of academia and innovation.

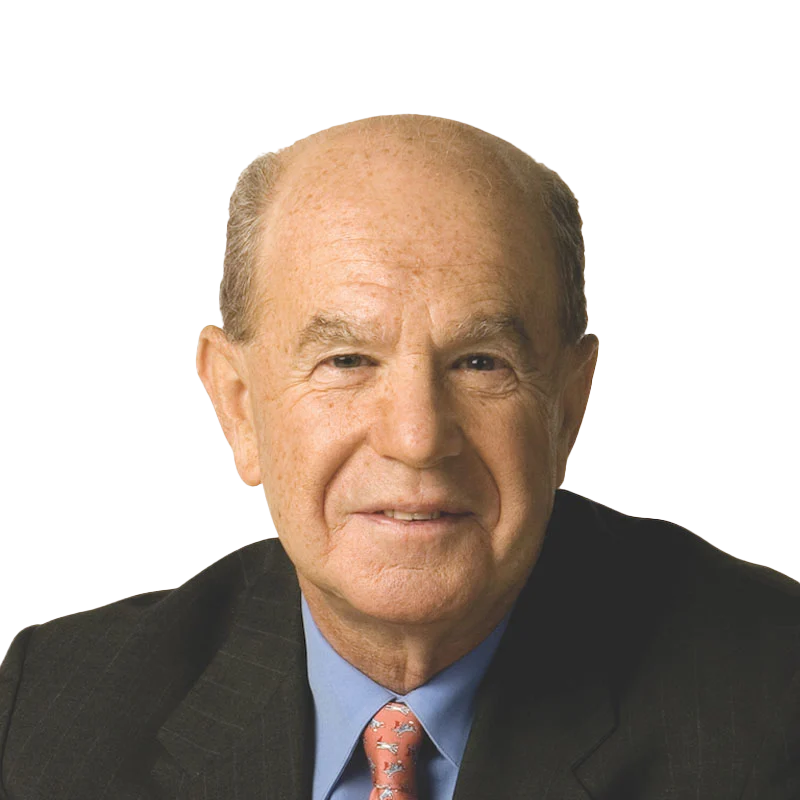

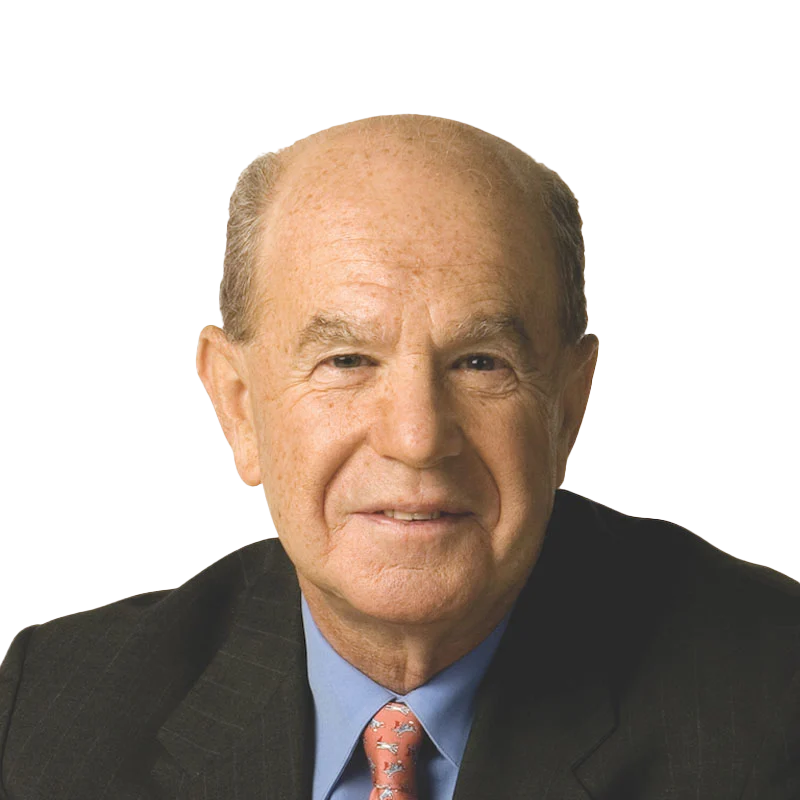

Dr Edward Altman

Co-founder and chairman of the advisory council

Dr Gabriele Sabato

Co-founder & CEO

Avantika Goel

Head of Wiserfunding India

Dr Galina Andreeva

Advisory Council

Keith Baker

VP of Product, Operations and Partnership

Jack Caouette

Board Member

João Carlos Douat

Advisory Council Member

Steven Clarke

Board Member

Mike Gallop

Chief Revenue Officer

Robert Garlick

Chief Financial Officer

Fiona Gibson

Board Member

Dr Walter Gontarek

Chairman

Tony Kao

Advisory Council Member

Mark Kronfeld

Advisory Council Member

Patrizio Messina

Advisory Council Member

Jay Runewitsch

Senior Adviser

Dr Markus Schmid

Senior Adviser

Kathleen Traynor Derose

Advisory Council Member

Ian Wilson

Senior Adviser

Jeremy Taylor

Chief Technology Officer

Dr Edward Altman

Co-founder and chairman of the advisory council

Dr Gabriele Sabato

Co-founder & CEO

Avantika Goel

Head of Wiserfunding India

Dr Galina Andreeva

Advisory Council

Keith Baker

VP of Product, Operations and Partnership

Jack Caouette

Board Member

João Carlos Douat

Advisory Council Member

Steven Clarke

Board Member

Mike Gallop

Chief Revenue Officer

Robert Garlick

Chief Financial Officer

Fiona Gibson

Board Member

Dr Walter Gontarek

Chairman

Tony Kao

Advisory Council Member

Mark Kronfeld

Advisory Council Member

Patrizio Messina

Advisory Council Member

Jay Runewitsch

Senior Adviser

Dr Markus Schmid

Senior Adviser

Kathleen Traynor Derose

Advisory Council Member

Ian Wilson

Senior Adviser

Jeremy Taylor

Chief Technology Officer